SaaS metrics vs Stage of a startup

Which SaaS metrics matter?

Every SaaS product needs to follow some metrics to measure the profitability and feasibility of the product. The earlier you measure your product’s performance on these metrics, the better chance you have being profitable in the long run.

There are multiple metrics to measure growth of a SaaS product. However, some are essential to track in early stage, some in growth stage and some in late stage of the product’s lifecycle.

But, what are those metrics? Which metrics should one follow?

Early Stage:

During early stage, a startup is more concerned about getting customers and meeting customer satisfaction level. At this stage you need to know how much people value your product and how much they are paying for it.

1. Net Promoter Score (NPS): In simple words, this score defines number of people who are actively promoting about your product through various multiple online channels. It is a management tool that can be used to gauge the loyalty of a firm’s customer relationships. NPS of more than 90 is highly appreciated.

2. Monthly Recurring Revenue (MRR): This is the most important number to be watched in SaaS industry, in every stage of the startup. This is the key indicator that shall help you to predict the profitability of your business. A higher MRR will help you to get better valuation and funding from early investors.

Growth Stage:

During the growth stage, a startup is more concerned about continuing its growth and attracting more customers, and increasing revenues per customer.

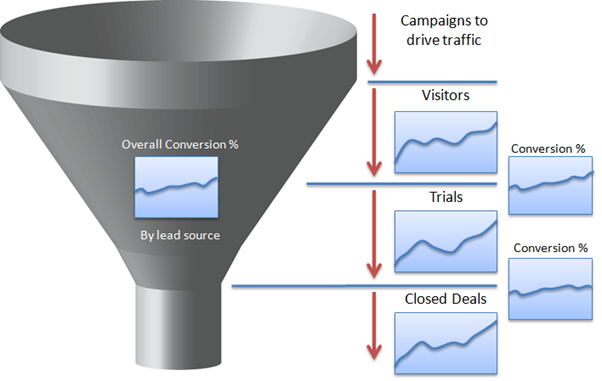

3. Funnel Conversion Rate (FCR): During growth stage, a startup needs to ensure to convert as many customers as possible through various marketing channels. This helps sales and marketing team to focus on a particular channel which has a higher conversion rate.

After analyzing conversion, it is important to analyze revenue and cost of acquiring that customer and how many months it will take to recover cost of acquisition.

4. Average Monthly Revenue Per User (ARPU): It is good to know the monthly recurring revenue, but it is better if you know ARPU for your product. This will help you to understand the spending capacity of the users and accordingly, you can tweak your pricing strategy.

5. Cost to Acquire Customer (CAC): Every startup must incur initial cash outflow known as Cost to Acquire Customer (CAC). However, the subscription tends to be either monthly, quarterly or annually, it is particularly important to find the number of months it will take to cover CAC. If your startup is capital intensive and requires continual cash flow to run the business, then you need to ensure that you cover your CAC within first 12 months.

6. Churn Rate: The rate at which customer stops subscribing the services is called churn rate. It is the most important variable to track in SaaS business. Churn rate can be attributed to the low customer satisfaction. Churn rate are like bad debts and you need to keep it minimal with reference to industry standard.

ARPU / CAC shall give you number of months required to cover the cost of acquisition. And managing churn will become important to make sure you are growing organically and strategically.

Later Stage:

At this stage, your startup has a strong product-market fit. This is the growth stage and startup needs to ensure to gain significant market share in the niche in which it is operating. In addition to above metrics, startup needs to make sure management uses following metrics to take decision:

7. Lifetime value (LTV): Every customer shall stay for a period with you. Some shall stay for months and some for years, but you need to ensure that LTV is always greater than CAC. It is an alarming situation if it is vice-versa.

8. Positive Cash Flow: Jot down the monthly cash inflow and cash outflow items. If your cash inflow > cash outflow than it is a positive indicator and your business is generating cash flows to manage your working capital. In early stage it is difficult to have a positive cash flow, but after reaching a point where startup is no more just a startup but a company, then you need to ensure to have a positive cash flow all the time.

It’s not too complicated and hope this simple primer on SaaS metrics help you track your KPIs right.

![A Simple Guide on Workflow Management Software [Updated 2025]](/blog/content/images/size/w960/2021/12/work-management-blog.png)

![Mastering Workflow Management: A Comprehensive Guide with Templates [2025]](/blog/content/images/size/w960/2023/09/Workflow-Management-A-Guide.png)