How to Build a Robust Deal Flow Pipeline for Your Investments

Learn how to build a strong deal flow pipeline for your investments with effective strategies, tools, and tips to maximize opportunities and drive long-term success.

In the competitive landscape of investing, success often hinges on the quality and quantity of opportunities at your fingertips. This is where a robust deal flow pipeline becomes a game-changer. Whether you're a seasoned venture capitalist, an ambitious angel investor, or part of a growing private equity firm, mastering deal flow management can be the key to unlocking unprecedented success. Let's dive deep into the world of deal flow and explore how you can build a pipeline that consistently delivers promising investment opportunities.

What is Deal Flow Management?

At its core, deal flow management is the lifeblood of any investment operation. It's the systematic process of organizing, tracking, and nurturing potential investment opportunities from the moment of initial contact through to the final investment decision. Think of it as your investment funnel - wide at the top, capturing a multitude of possibilities, and narrowing down to the select few that meet your specific criteria.

Effective deal flow management isn't just about quantity; it's about quality and efficiency. It ensures that:

- No promising opportunities slip through the cracks

- Your time and resources are allocated to the most potential-rich prospects

- You have a clear, bird's-eye view of your investment landscape at any given time

- You can make data-driven decisions based on historical patterns and current trends

For example, a venture capital firm might receive hundreds of pitches each month. Without a robust deal flow management system, they might miss out on the next unicorn startup simply because they couldn't process all the incoming opportunities effectively.

What is Venture Capital Dealflow?

Venture Capital (VC) dealflow is a specific subset of deal flow, focused on the rate at which investment pitches and business proposals are received by venture capital firms. It's the pulse of the VC industry, providing a constant stream of potential investments to evaluate.

A healthy VC dealflow is characterized by:

- Diversity: A mix of industries, stages, and investment sizes

- Consistency: A steady stream of opportunities rather than feast-or-famine cycles

- Quality: Opportunities that align with the firm's investment thesis and criteria

- Volume: Enough deals to allow for selectivity and comparison

For instance, a VC firm specializing in early-stage tech startups might aim for a dealflow of 100-200 pitches per month, with a diverse mix of B2B and B2C companies across various tech sectors.

How to Increase Deal Flow?

Increasing your deal flow is about expanding your reach while maintaining the relevance and quality of opportunities. Here are some strategies to boost your deal flow, along with practical examples:

Create a Network for Long-term Basis

Building a strong, diverse network is perhaps the most effective way to increase deal flow. This network should include:

- Other investors: They can provide referrals and co-investment opportunities. For example, you might join an angel investor network or attend VC conferences to connect with peers.

- Entrepreneurs: Even if you don't invest in their current venture, they might refer you to others or come back with future opportunities. Consider mentoring at a startup accelerator to build these relationships.

- Industry experts: They can provide valuable insights and introductions. Attend or speak at industry conferences to connect with these experts.

- Lawyers and accountants: These professionals often have early knowledge of companies seeking investment. Build relationships by offering to speak at their firms about investment trends.

- Accelerators and incubators: They're excellent sources of early-stage startups. Partner with local accelerators to get first looks at their cohorts.

- University entrepreneurship programs: These can be great sources of innovative ideas and young talent. Offer to judge pitch competitions or mentor student entrepreneurs.

- Online platforms: Websites like AngelList, Gust, or PitchBook can expand your reach beyond your immediate network.

Remember, networking is a two-way street. Provide value to your network by sharing insights, making introductions, or offering advice, and they'll be more likely to bring opportunities your way.

How to Improve Deal Flow?

Improving deal flow isn't just about quantity—it's about quality and efficiency. Here are some strategies to enhance your deal flow:

Examine Your Network for Recommendations

Regularly reach out to your network for recommendations. Let them know what types of deals you're looking for and ask if they know of any suitable opportunities. For example, you might send a quarterly email to your network outlining your current investment focus and asking for introductions to relevant companies.

Review the Recommendations You Passed On from Executives

Sometimes, timing is everything. Deals you passed on previously might be worth a second look. Keep track of these and periodically review them. Perhaps a startup you passed on six months ago has now gained significant traction or pivoted to a more promising business model.

Search in New Regions

Expanding your geographical focus can open up new opportunities. Consider looking into emerging markets or regions outside your usual scope. For instance, if you typically invest in Silicon Valley startups, you might explore opportunities in emerging tech hubs like Austin, Toronto, or Berlin.

Build Your Reputation

Become known as a valuable partner, not just a source of capital. Share your expertise, mentor entrepreneurs, and actively participate in the startup ecosystem. A strong reputation will attract more and better deals. You could:

- Write a blog or newsletter sharing your investment insights

- Speak at industry events or startup conferences

- Offer office hours for entrepreneurs seeking advice

- Engage actively on social media platforms like Twitter or LinkedIn

Leverage Technology

Use AI and machine learning tools to help identify promising opportunities early. For example, you could use natural language processing to analyze news articles and social media to spot emerging trends or promising startups before they hit the mainstream.

Deal Flow Best Practices

To make the most of your deal flow, consider these best practices:

#1. Automating Data Entry

Use tools and software to automate the capture and organization of deal information. This saves time and reduces the risk of human error. For example, you could use a tool like Zapier to automatically create new entries in your deal flow management system when you receive an email pitch or when a form on your website is filled out.

#2. Valuable Information

Focus on collecting the most relevant information for each deal. This might include:

- Financials: Current revenue, growth rate, burn rate, etc.

- Market size: Total addressable market, serviceable addressable market, serviceable obtainable market

- Competitive landscape: Key competitors, your potential company's unique value proposition

- Team background: Founders' experience, key team members' expertise

- Traction: User growth, partnerships, pilot programs

- Funding history: Previous rounds, current cap table

#3. Reflecting, Analyzing, Optimizing

Regularly review your deal flow process. Analyze what's working and what isn't, and continually optimize your approach. You might:

- Track your deal flow metrics (e.g., number of deals reviewed, time spent per deal, conversion rates at each stage)

- Conduct post-mortems on both successful and unsuccessful investments

- Survey entrepreneurs who've gone through your process for feedback

- Stay updated on best practices in the industry and experiment with new approaches

5 Top Deal Flow Management Tools for Startups and Investors

Let's explore some of the best tools available for managing your deal flow:

1. Stackby - Best Deal Flow Management Tool

Stackby stands out as a versatile and user-friendly option for deal flow management.

Best Features

- Customizable Database templates for various deal flow needs

- Integration with multiple data sources (e.g., Excel, Google Sheets, Airtable)

- Visual pipeline views for easy deal tracking

- Collaboration features for team-based evaluation

- Automated workflows to streamline processes

- Real-time updates and notifications

Stackby - Affordable Pricing Plan

Stackby offers a range of plans to suit different needs:

- Free plan for small teams

- Personal plan at $5/month

- Professional plan at $9/user/month

- Business plan at $18/user/month (Prices may vary, please check the official website for the most current pricing)

3 Best Stackby Deal Flow Templates for Free

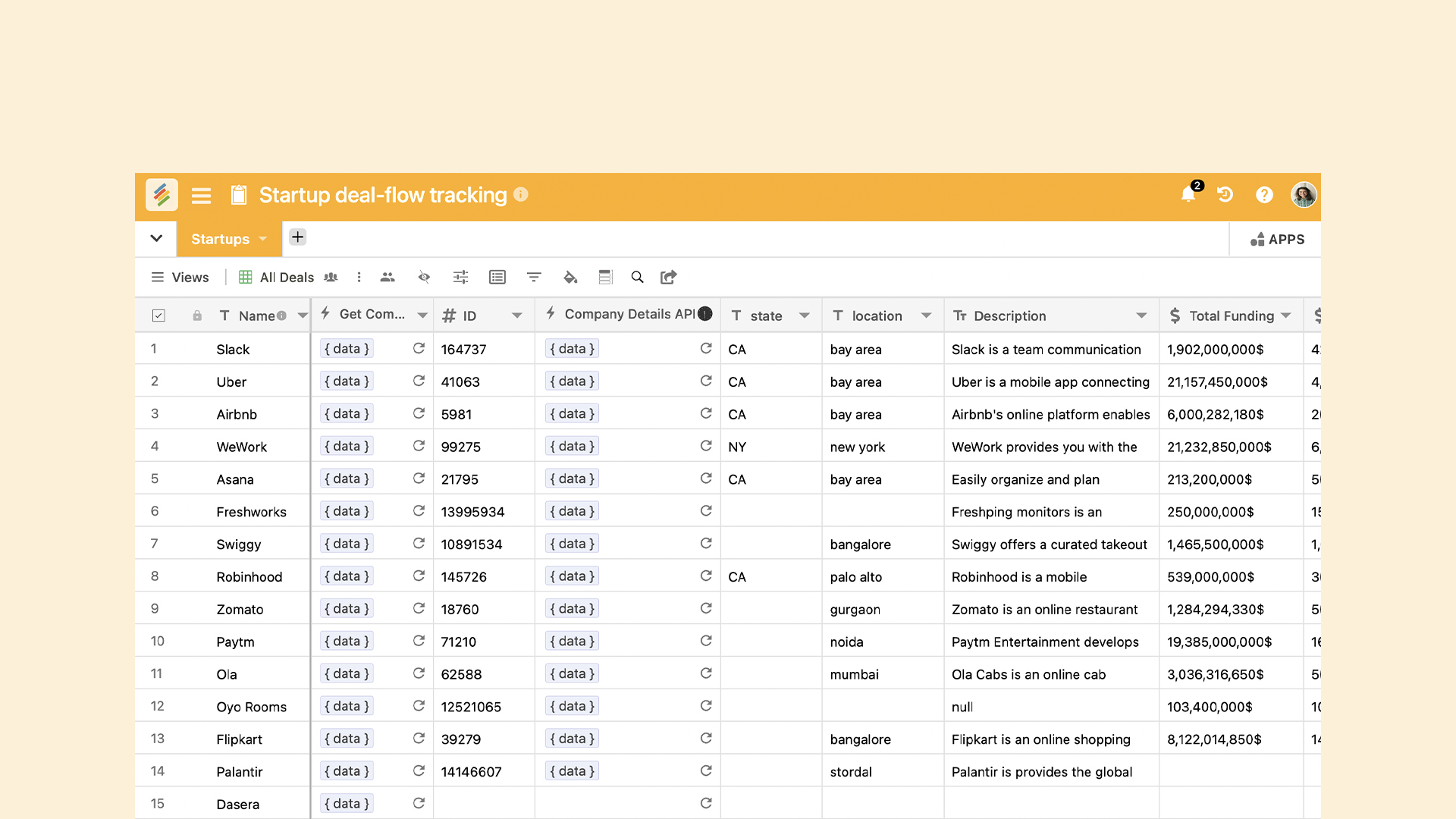

#1. Start-up DealFlow Tracking:

Perfect for monitoring early-stage investment opportunities. This template includes fields for key metrics like traction, team background, and market size.

#2. Deal Flow CRM:

Ideal for managing relationships with potential investees. It includes features for tracking communications, setting reminders, and noting key contact information.

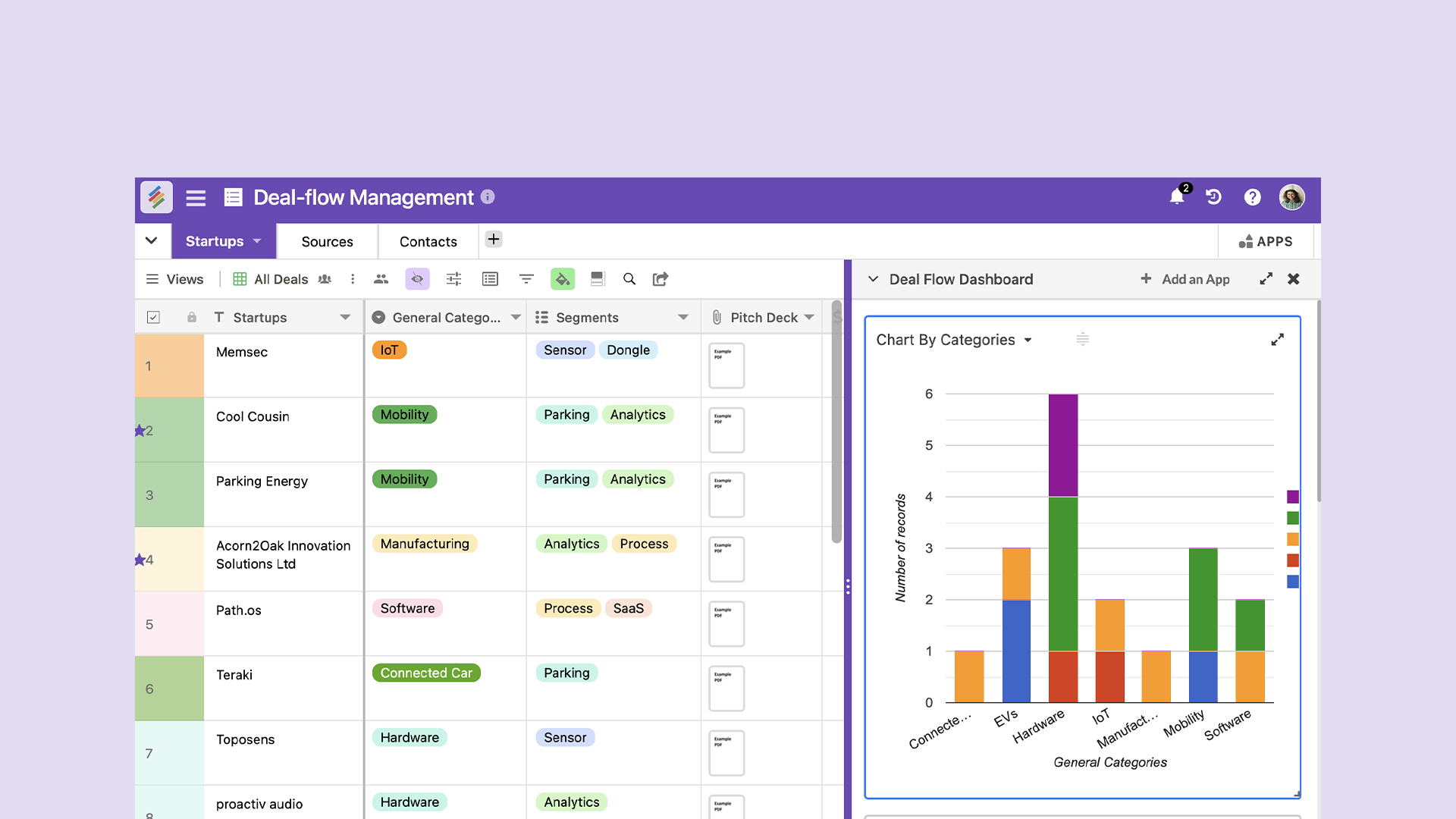

#3. Deal Flow Management:

A comprehensive template for end-to-end deal flow management, from initial contact to final investment decision. It includes stages for screening, due diligence, and post-investment monitoring.

2. Engagebay

Engagebay is an all-in-one marketing, sales, and support solution that can be adapted for deal flow management.

Best Features

- Integrated CRM for managing investor-investee relationships

- Marketing automation to nurture leads

- Advanced analytics for data-driven decision making

- Email tracking and scheduling

Pricing

Engagebay offers a free plan and paid plans starting at $8.99/user/month, with more advanced features available in higher-tier plans.

3. Pipedrive

Pipedrive is a sales-focused CRM that can be effectively used for deal flow management.

Best Features

- Visual sales pipeline for clear deal tracking

- AI-powered sales assistant for insights and predictions

- Customizable fields and workflows to match your process

- Mobile app for on-the-go deal management

Pricing

Pipedrive's plans start at $12.50/user/month, billed annually, with more advanced features available in higher-tier plans.

4. Zoho CRM

Zoho CRM is a comprehensive customer relationship management tool that can be adapted for deal flow management.

Best Features

- AI-powered sales assistant for deal insights

- Advanced analytics and reporting for data-driven decisions

- Multichannel communication (email, phone, social media) integration

- Customizable modules and fields

Pricing

Zoho CRM offers a free plan for up to 3 users, with paid plans starting at $14/user/month. More advanced features are available in higher-tier plans.

5. TeamLeader

TeamLeader is a comprehensive business management tool that includes features suitable for deal flow management.

Best Features

- Project management integration for post-investment tracking

- Time tracking to optimize deal evaluation processes

- Invoicing capabilities for managing investment-related expenses

- CRM features for managing investor and investee relationships

Pricing

TeamLeader's pricing starts at €50/month for 2 users, with custom pricing available for larger teams or more advanced needs.

Conclusion: Manage Diverse Deal Flow Templates with Stackby Free Database Templates

Building a robust deal flow pipeline is crucial for any investor looking to stay competitive and maximize returns. By implementing the strategies discussed—from networking and reputation building to leveraging powerful management tools—you can significantly enhance both the quantity and quality of your deal flow.

Remember, the key to successful deal flow management is not just about having a large volume of deals, but about efficiently identifying and focusing on the most promising opportunities. Tools like Stackby can play a crucial role in this process, offering customizable templates that cater to various deal flow needs.

Whether you're tracking startup investments, managing a complex CRM, or overseeing a comprehensive deal flow process, Stackby's free templates provide a solid foundation. They offer the flexibility to adapt to your unique workflow while providing the structure needed for effective deal management.

As you implement these strategies and tools, continually reflect on your process, analyze the results, and optimize your approach. The investment landscape is always evolving, and so should your deal flow management tactics. Consider:

- Regularly reviewing and updating your investment criteria

- Staying informed about emerging trends and technologies in your target sectors

- Continuously expanding and nurturing your professional network

- Investing in your team's skills and knowledge to improve deal evaluation capabilities

- Regularly soliciting feedback from both successful and unsuccessful investment prospects

By building a robust deal flow pipeline, you're not just improving your chances of finding the next big investment opportunity—you're positioning yourself for long-term success in the competitive world of investing. A well-managed deal flow can lead to:

- More high-quality investment opportunities

- Improved decision-making through better comparative analysis

- Increased efficiency in the investment process

- Enhanced reputation in the market, attracting even more deals

- Better returns through a more strategic and data-driven approach to investing

Start enhancing your deal flow today, and watch as your investment opportunities grow and thrive. With the right strategies, tools, and mindset, you can transform your deal flow from a trickle to a torrent of promising opportunities, setting the stage for investment success in the years to come.

![Step by Step Guide on How to Build Forms in a Database [2026]](/blog/content/images/2022/03/form-database-blog.png)